Congratulations, you landed your first job! Be sure you know how to read your paystub.

Most people don’t bother reading their paystubs. After all, what matters most is the total amount you can deposit into your bank account, right?

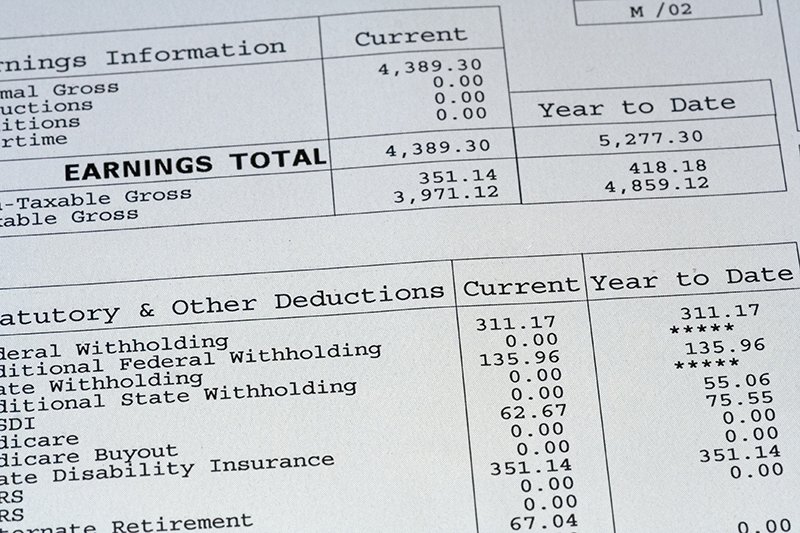

Wrong. Although you can go through life without ever looking at your pay stub, being able to understand the information in it is important for knowing what deductions are being taken out of your pay and where your money is going. If you don’t know how to read your paystub, you might be losing money that you earned.

Paystubs can be difficult to read, and the terms used may not be familiar, so here’s a handy guide for reference.

-

Pay Period: The date range covered in the pay stub. Most companies follow the bi-weekly pay period, but there are some who prefer the monthly or bi-monthly option.

-

Gross Pay: The total income earned during the pay period before the deductions. This should always correspond with the wages in your employment contract.

-

Net Pay: The amount you take home after all the deductions are removed from the gross pay. This is the amount you are paid either with a check or directly deposited into your bank account.

-

Taxes: In Hawaii, there are two primary types of taxes that will appear: federal and state. These taxes are based on the amount you earn and are deducted from your gross pay every payday. Upon employment, you are required to fill out a W-4 form. This will be used as the basis of your federal tax amount. Exemptions can lower the amount of tax you have to pay.

-

Medicare: A mandatory deduction required by the government that requires that all employees contribute 1.45% of their gross pay and employers matching each employee contribution. Medicare provides health insurance for retirees and the disabled.

-

Social Security: A government-mandated retirement fund that aims to provide a reliable monthly pension to each of its retired members. Every employee is required to contribute 6.2% of gross pay to and employers are required to match that amount.

-

Year-to-Date Information: Details the total amount paid to all the required withholdings for the entire year.

-

Health Insurance: Monthly deductions for health insurance, apart from Medicare. This will depend entirely on the company’s policies.

-

Employer-Sponsored Retirement Account Contributions: Many companies offer private or alternative retirement savings plans, like a 401k or defined benefit plan.

-

Flexible Spending Account (FSA): An account that allows you to save pre-tax earnings for qualified covered medical expenses.

Get familiar with your paystub acronyms and abbreviations:

-

FT or FED is Federal Tax

-

ST is State Tax

-

SS is Social Security

-

OT is Overtime

-

MWT (sometimes referred to as Med) is Medicare

-

EIN is Employee Identification Number

-

FICA is Federal Insurance Contributions Act